The latest release from S&P Dow Jones Indices (S&P DJI) offers promising insights into the state of the U.S. housing market. The January 2024 results for the S&P CoreLogic Case-Shiller Indices highlight persistent growth, with key metrics indicating sustained upward momentum in home prices across major metro markets. Let’s delve into the details of this encouraging report.

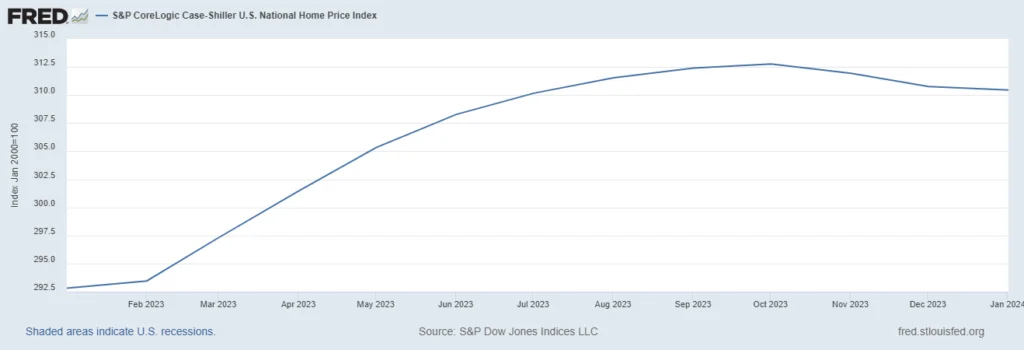

S&P/Case-Shiller Home Price Index

Year-over-Year Performance: The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a noteworthy 6.0% annual gain in January, marking an increase from the 5.6% rise recorded in the previous month. This steady growth underscores the resilience of the housing sector on a national scale.

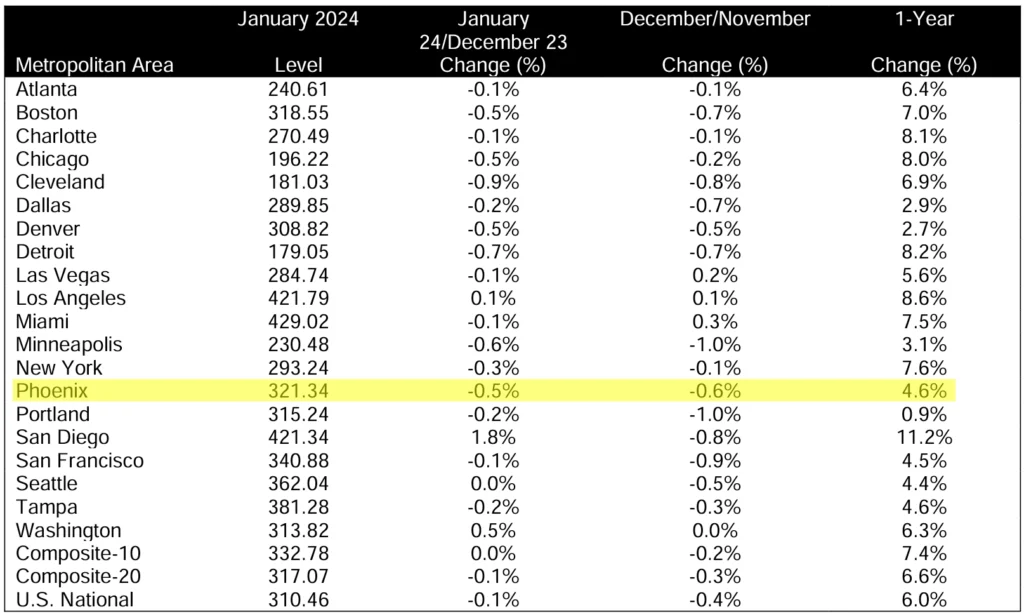

Furthermore, the 10-City Composite exhibited a significant year-over-year increase of 7.4%, surpassing the 7.0% uptick observed in the preceding month. Similarly, the 20-City Composite posted a commendable 6.6% year-over-year increase, reflecting an improvement from the 6.2% rise in the previous month.

Regional Highlights: Among the 20 cities tracked by the indices, San Diego emerged as a standout performer, reporting the highest year-over-year gain with an impressive 11.2% increase in January. This robust growth solidifies San Diego’s position as a thriving real estate market.

Following closely behind, Los Angeles recorded a substantial 8.6% increase, indicating sustained positive momentum in the region’s housing sector. Even in areas with comparatively modest growth, such as Portland, there remains an upward trend, with a 0.9% increase this month, demonstrating resilience and potential.

Monthly Trends: While the U.S. National Index and the 20-City Composite experienced a slight decrease of 0.1% month-over-month, the 10-City Composite remained unchanged in January. However, after seasonal adjustment, all three indices posted month-over-month increases, with the U.S. National Index, the 20-City Composite, and the 10-City Composite recording upticks of 0.4%, 0.1%, and 0.2%, respectively.

Insights from Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices: According to Brian D. Luke, the robust performance of U.S. home prices continues to drive higher, with the National Composite rising by 6% in January, marking the fastest annual rate since 2022. Notably, all cities reported increases in annual prices for the second consecutive month, with San Diego leading the pack with a surge of 11.2%.

Luke highlights the consistency in market performance across 2023, emphasizing that while there may be disparities between cities, the broad market performance remains tightly bunched up. He notes that homeowners across various cities and neighborhoods likely saw healthy gains over the past year, reflecting the resilience of the housing market.

However, despite this inherent time lag, the numbers paint a fascinating picture. Currently, all 20 cities under scrutiny are experiencing an upward trajectory in home prices over the past few months. Among the standouts is Phoenix, where the index has surged for the fifth consecutive month.

Home Prices

- January 2024 Sees Continued Growth

- San Diego leads with an impressive 11.2% gain

- Market Resilience and Consistency

Phoenix shows an impressive streak of growth for the fifth consecutive month. This increase in home prices not only underscores the city’s resilience but also signifies its growing appeal in the real estate landscape. Phoenix’s enduring popularity as a housing market is attracting both homebuyers and investors, making it a region to watch closely for those seeking opportunities in the ever-evolving world of real estate.

20 Cities S&P CoreLogic Indices

The January 2024 report from the S&P CoreLogic Case-Shiller Indices paints a picture of a housing market characterized by resilience, consistency, and steady growth. Despite challenges such as elevated borrowing costs, the sector continues to demonstrate strength and stability, with widespread year-over-year price gains across major metro markets. As we move forward, it will be intriguing to observe how these trends evolve and shape the trajectory of the broader economic landscape.